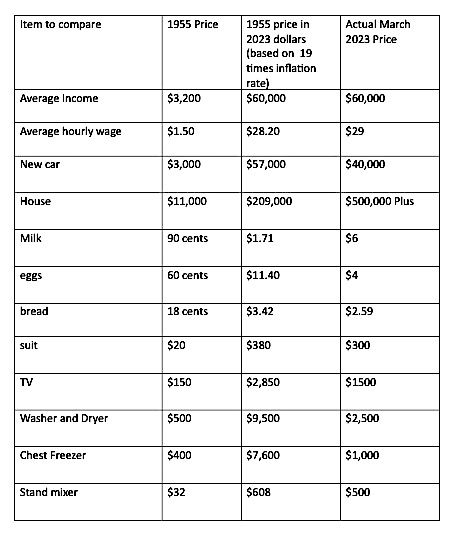

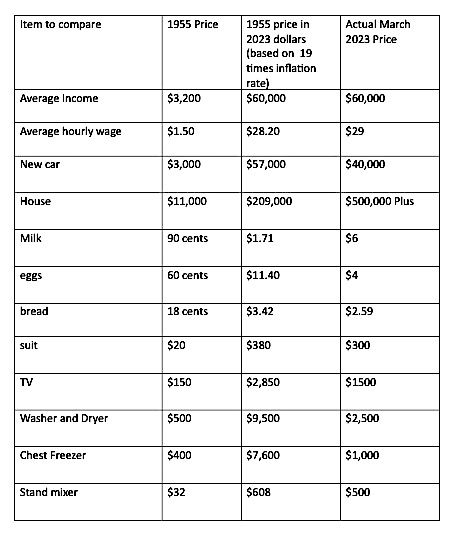

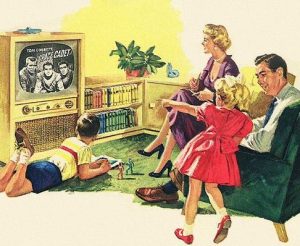

It is easy to think the mid-century era was a golden age with a booming economy and low prices for food, cars, housing and clothing. Perhaps the most enviable statistic of all is that a three bedroom bungalow sold for an average of $11, 000 in 1955. You can’t buy a dog house for that in 2023. So let’s look at price information from then and now to see if it really was a golden age.

Below is a chart that shows my research for the 1955 price of comparable items , the price adjusted for inflation to 2023 dollars, and the actual 2023 prices I found online today.

Most families had only one income from the “man of the house”. The average family income was about $3,200 per year. In 2023 the average income is $60,000 per year. That is about a 19 times inflation rate and so I have used that rate to compare prices. However, not all prices across the board have increased 19 times and some have increased very much less than that.

Since a house is usually the biggest item a family will purchase let’s look at housing costs in 1955. The average house price was $10,950 and interest rates were 4.5 per cent. This would mean a $70 monthly mortgage payments over a 25 year period. The mortgage payment took one week’s pay cheque per month. In 2023 dollar terms adjusting for inflation we might expect the cost of the average house to be about $200,000 today. Alas, in my part of the world it is more like to $500,000 or more. That means in 2023 a new homebuyer would have a monthly mortgage payment of about $2500 per month over 25 years. That is half of the average worker’s monthly income in 2023. Compare that to about a quarter of the 1955 monthly income. This math alone shows why it is so much more difficult for a young person to buy a house today than in the mid-century. Even a two income family would struggle with the mortgage for a new family home. No Zoomer or Millennial bashing here. When it comes to buying a house the playing field is not at all the same in 2023.

New suburbs were built everywhere after the second world war and were considered the ideal family home. But this also meant that a reliable car was needed to get to work. The average cost of a new car in 1955 was $3000. Assuming the same 4.5 % interest rates over a 5 year repayment loan, the car payments would be $50 per month. This is almost a week’s wages in 1955 dollars. No wonder there were few two car families. Translating 1955 prices into today’s dollar, you will find a no frills new car would cost $42,000 with a $700.00 loan payment per month. That means that in 2023 you could think about being a two car family as long as you didn’t have a very large mortgage because the car payment would be about three day’s pay- less than in 1955.

New suburbs were built everywhere after the second world war and were considered the ideal family home. But this also meant that a reliable car was needed to get to work. The average cost of a new car in 1955 was $3000. Assuming the same 4.5 % interest rates over a 5 year repayment loan, the car payments would be $50 per month. This is almost a week’s wages in 1955 dollars. No wonder there were few two car families. Translating 1955 prices into today’s dollar, you will find a no frills new car would cost $42,000 with a $700.00 loan payment per month. That means that in 2023 you could think about being a two car family as long as you didn’t have a very large mortgage because the car payment would be about three day’s pay- less than in 1955.

In 1955 milk was 90 cents a gallon, eggs were 60 cents per dozen and bread was 18 cents. Sounds great but remember you need to work for an hour to buy milk and eggs. Now, we are all painfully aware that prices have been rising sharply in recent years. However, I was surprised when I crunched the numbers that food prices were much under what we might expect given the inflation rate from 1955 and today. See the chart above to view the details.

The average wardrobe was very different in the mid-century- we might say uncomfortably formal -with most people wearing suits and hats everyday. Most men wore suits or uniforms to work. Most women wore a suit to church or to go to an appointment. In 1955 a man’s suit cost about $26. A woman’s summer suit was around $10 and a winter suit was about $25 with a blouse around $5. Most men had two suits for summer and winter, while a housewife might get away with one good suit for summer and one for winter. Most women sewed at least some of their clothing and much of their childrens’ as well. Relatively speaking the cost for “store bought” clothing was high in 1955. It would take 30 hours of work to pay for a good quality woollen suit with shirt or blouse. For comparison, today a decent quality suit from a mall store will cost about $400. In 2023 it would take about 15 hours of work to pay for it. Although I will note that based on vintage clothes both the quality of the fabric and the workmanship of the 2023 suit is likely to be far below the 1955 suit. Good quality would be important to mid-century citizens because the 1955 suit had to stand up to many years of wear. They didn’t think of clothing as going out of fashion in a year or two. However, you can see in the chart that the price of suits have stayed in line with inflation rates more than the prices of houses.

The average wardrobe was very different in the mid-century- we might say uncomfortably formal -with most people wearing suits and hats everyday. Most men wore suits or uniforms to work. Most women wore a suit to church or to go to an appointment. In 1955 a man’s suit cost about $26. A woman’s summer suit was around $10 and a winter suit was about $25 with a blouse around $5. Most men had two suits for summer and winter, while a housewife might get away with one good suit for summer and one for winter. Most women sewed at least some of their clothing and much of their childrens’ as well. Relatively speaking the cost for “store bought” clothing was high in 1955. It would take 30 hours of work to pay for a good quality woollen suit with shirt or blouse. For comparison, today a decent quality suit from a mall store will cost about $400. In 2023 it would take about 15 hours of work to pay for it. Although I will note that based on vintage clothes both the quality of the fabric and the workmanship of the 2023 suit is likely to be far below the 1955 suit. Good quality would be important to mid-century citizens because the 1955 suit had to stand up to many years of wear. They didn’t think of clothing as going out of fashion in a year or two. However, you can see in the chart that the price of suits have stayed in line with inflation rates more than the prices of houses.

One thing that stands out in the chart is the price of household appliances, many of which were new to the market in the 1950’s and quite pricey. The house proud mid-century homeowners wanted to have the most efficient, beautiful and modern house possible. The most popular new appliances in 1955 were: a TV at $150.00, an electric automatic washer and dryer at $500, and a stand alone freezer (called a “deep freeze” by my mom) at $400. A smaller but equally desired appliance was the stand mixer for about $32. How do the inflated prices match current prices? Today all of these appliances sell for much less than the price you would could expect based on inflation rates.

The world of manufacturing of has changed in many ways since 1955 and that has affected prices, quality and availability of some consumer goods. Even without a pandemic to increase prices and decrease supply, globalization has changed where the factories produce clothing, furniture and appliances and and the materials that are used. And while there were many mail order catalogues in 1955, there were also many more department stores in towns and cities so people could shop locally. Today it is hard to find a well-stocked department store in every town or city and more things are being supplied via Amazon or similar suppliers from all around the world.. Anyone who has looked at a 1955 mail order catalogue might lament with me that it is nearly impossible to find a gorgeous rayon crepe summer suit today anything like those sold everywhere in the mid-century, at any price.

My verdict after looking at all these facts and figures? Overall, looking back and comparing to today, we made some gains and took some losses. I would call it a draw overall. We pay way more for housing, but way less for appliances and food than inflation would predict. But what remains the same is that any middle class, average family has to work hard and be wise to keep afloat whether in 1955 or 2023. In my opinion there was no golden age in the mid-century.

What was it? Why a meal in a box, almost. In the box was a package of dried noodles and a powdered seasoning or sauce. Once you browned a pound of hamburger you added the sauce and noodles and some water. Then just cover for a few minutes and voila dinner was ready. It made the frugal housewife’s standard protein, hamburger, into something special. It was said to help stretch a pound of hamburger to feed a family of five. And at well under a dollar (65 cents when launched) a package helped the inflation hit food budget of the middle 1970’s stretch too.

What was it? Why a meal in a box, almost. In the box was a package of dried noodles and a powdered seasoning or sauce. Once you browned a pound of hamburger you added the sauce and noodles and some water. Then just cover for a few minutes and voila dinner was ready. It made the frugal housewife’s standard protein, hamburger, into something special. It was said to help stretch a pound of hamburger to feed a family of five. And at well under a dollar (65 cents when launched) a package helped the inflation hit food budget of the middle 1970’s stretch too.

New suburbs were built everywhere after the second world war and were considered the ideal family home. But this also meant that a reliable car was needed to get to work. The average cost of a new car in 1955 was $3000. Assuming the same 4.5 % interest rates over a 5 year repayment loan, the car payments would be $50 per month. This is almost a week’s wages in 1955 dollars. No wonder there were few two car families. Translating 1955 prices into today’s dollar, you will find a no frills new car would cost $42,000 with a $700.00 loan payment per month. That means that in 2023 you could think about being a two car family as long as you didn’t have a very large mortgage because the car payment would be about three day’s pay- less than in 1955.

New suburbs were built everywhere after the second world war and were considered the ideal family home. But this also meant that a reliable car was needed to get to work. The average cost of a new car in 1955 was $3000. Assuming the same 4.5 % interest rates over a 5 year repayment loan, the car payments would be $50 per month. This is almost a week’s wages in 1955 dollars. No wonder there were few two car families. Translating 1955 prices into today’s dollar, you will find a no frills new car would cost $42,000 with a $700.00 loan payment per month. That means that in 2023 you could think about being a two car family as long as you didn’t have a very large mortgage because the car payment would be about three day’s pay- less than in 1955. The average wardrobe was very different in the mid-century- we might say uncomfortably formal -with most people wearing suits and hats everyday. Most men wore suits or uniforms to work. Most women wore a suit to church or to go to an appointment. In 1955 a man’s suit cost about $26. A woman’s summer suit was around $10 and a winter suit was about $25 with a blouse around $5. Most men had two suits for summer and winter, while a housewife might get away with one good suit for summer and one for winter. Most women sewed at least some of their clothing and much of their childrens’ as well. Relatively speaking the cost for “store bought” clothing was high in 1955. It would take 30 hours of work to pay for a good quality woollen suit with shirt or blouse. For comparison, today a decent quality suit from a mall store will cost about $400. In 2023 it would take about 15 hours of work to pay for it. Although I will note that based on vintage clothes both the quality of the fabric and the workmanship of the 2023 suit is likely to be far below the 1955 suit. Good quality would be important to mid-century citizens because the 1955 suit had to stand up to many years of wear. They didn’t think of clothing as going out of fashion in a year or two. However, you can see in the chart that the price of suits have stayed in line with inflation rates more than the prices of houses.

The average wardrobe was very different in the mid-century- we might say uncomfortably formal -with most people wearing suits and hats everyday. Most men wore suits or uniforms to work. Most women wore a suit to church or to go to an appointment. In 1955 a man’s suit cost about $26. A woman’s summer suit was around $10 and a winter suit was about $25 with a blouse around $5. Most men had two suits for summer and winter, while a housewife might get away with one good suit for summer and one for winter. Most women sewed at least some of their clothing and much of their childrens’ as well. Relatively speaking the cost for “store bought” clothing was high in 1955. It would take 30 hours of work to pay for a good quality woollen suit with shirt or blouse. For comparison, today a decent quality suit from a mall store will cost about $400. In 2023 it would take about 15 hours of work to pay for it. Although I will note that based on vintage clothes both the quality of the fabric and the workmanship of the 2023 suit is likely to be far below the 1955 suit. Good quality would be important to mid-century citizens because the 1955 suit had to stand up to many years of wear. They didn’t think of clothing as going out of fashion in a year or two. However, you can see in the chart that the price of suits have stayed in line with inflation rates more than the prices of houses. When we see pictures of mid-century housewives they a

When we see pictures of mid-century housewives they a family income was about $3500 or about $1.50 per hour. It would take 20 hours of work to pay for a good quality woollen suit. You can see that store bought clothing was relatively expensive to buy and then perhaps required dry cleaning. Homemade clothes were a lot of work to make, then perhaps hand wash and iron. Either way it took a lot of time or money to get clothes. So people didn’t have a walk in closet full of fast fashion easy care clothing. They had a much smaller wardrobe and wore their clothes for many more years than we do. Since much clothing was made from natural fibres like wool and cotton, they had to take more time and care in cleaning their clothes than many of us do today. There was no convenience of throwing a load of laundry into the washer and dryer every morning for most housewives at this time.

family income was about $3500 or about $1.50 per hour. It would take 20 hours of work to pay for a good quality woollen suit. You can see that store bought clothing was relatively expensive to buy and then perhaps required dry cleaning. Homemade clothes were a lot of work to make, then perhaps hand wash and iron. Either way it took a lot of time or money to get clothes. So people didn’t have a walk in closet full of fast fashion easy care clothing. They had a much smaller wardrobe and wore their clothes for many more years than we do. Since much clothing was made from natural fibres like wool and cotton, they had to take more time and care in cleaning their clothes than many of us do today. There was no convenience of throwing a load of laundry into the washer and dryer every morning for most housewives at this time.